Happy Friday!

The Federal Open Market Committee met last week to announce projections for the near-future, and Fed Chairman Jerome Powell has spoken on the state of the economy several times since the Fed’s announcements.

Fed Projections

Despite a significant growth update, the Fed remains firm on keeping interest rates low until 2024. In addition, Powell announced that he expects inflation to rise above the Fed’s previous targets, and projects inflation will reach around 2.4%.

The largest takeaways from the Fed’s projections were as follows:

Near zero interest rates through 2023

Real gross domestic product growth of 6.5%, a 2.3% jump from December’s projection of 4.2%

A 4.5% unemployment rate for 2021, which is a 0.5% fall from the most recent statement of 5%

Inflation of 2.4%, above it’s previous estimate of 1.8%

Real GDP forecast rose 0.1%, from its previous estimate of 3.2% to 3.3%.

The following table, taken straight from the Fed’s March 17th release, shows this in more detail:

As the yields on 10-year treasury bonds soared, tech stock indexes fell — as expected.

Wells Fargo predicts that the 10-year yield could reach 2.25% this year, as investors adjust expectations based on inflations projections and a seemingly quick-to-respond Fed.

Looking at the longer term

The Fed doesn’t expect to keep interest rates low forever, and while they do intend to keep the near-zero rate until 2023, their dot plot shows plans for a substantial increase in the longer-run:

Whether or not we are suppressing the interest rate will become apparent as we move past the pandemic and into a state of heightened economic growth. Real GDP growth has typically averaged around 5%, and a projection of 6.5% would mean that growth will reach levels it has not seen in 40 years.

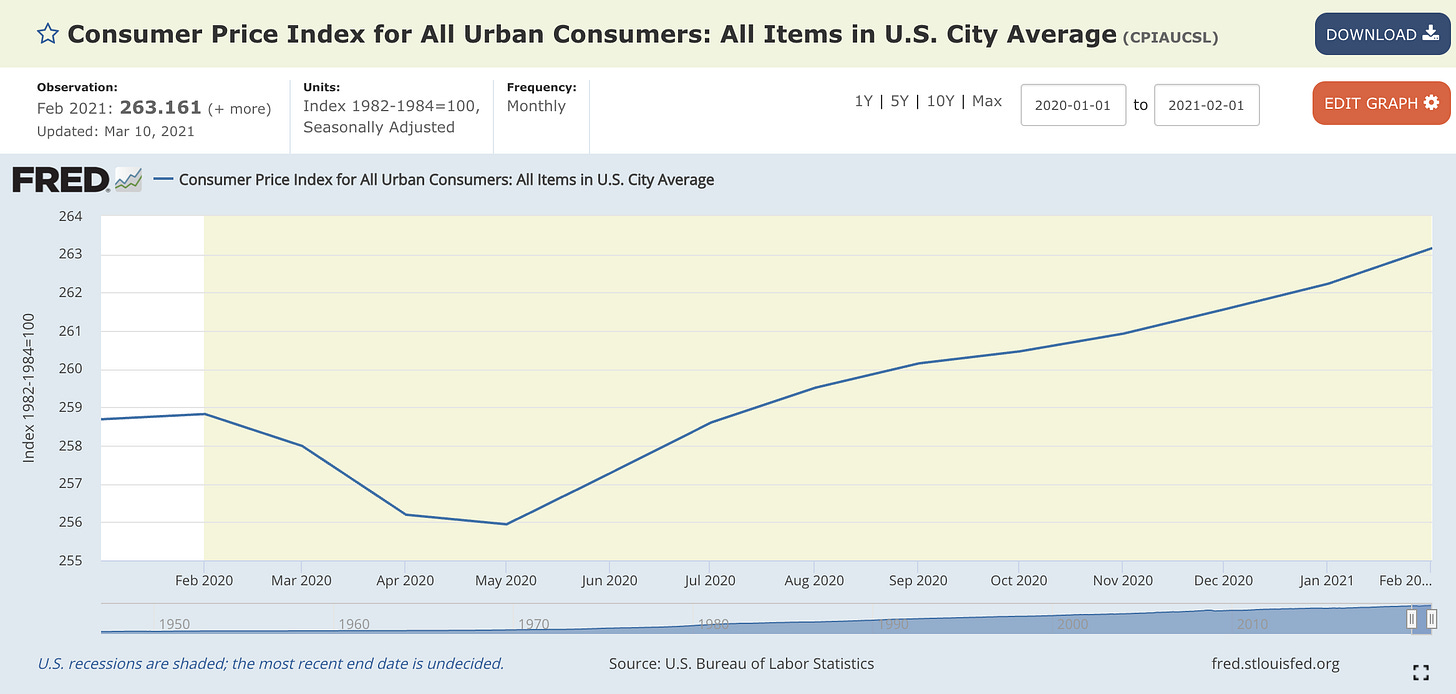

The CPI-U was down 0.6 percent for most of 2020. Why has inflation failed to keep up with money growth?

Is it only because there’s a long and variable lag between money growth and a corresponding rise in the CPI? Will we have double-digit inflation during the second half of 2020? *Cue dramatic music*

Last summer, Larry White wrote about high inflation worries following the Fed’s money-printing.

Note: The M1 graph pictured above has been discontinued, with its suggested replacement being the M1SL, pictured below

White noted that although we cannot forecast Fed policy, double digit inflation is unlikely — something I strongly agree with. The surge in money growth we’ve seen since the start of the pandemic is thanks to measures such as quantitative easing and has not been paired with disturbances to the CPI (or inflation in prices). I have seen this part of the argument, specifically, used as ammunition for debates on why we should be prepared for significant de-valuation of the dollar — which is misleading at best. The CPI has not remained undisturbed due to rigidities, but because prices actually fell in the early months of the pandemic as demand was suppressed by lockdown measures.

Why is this? Thus far, the surge in money growth has been offset by a drop in spending. Much of this drop in spending was due to lockdown measures, and it’s crucial to note that this phenomena is observable not only in the United States, but globally, which has resulted in the suppression of spending throughout the beginning of the COVID-19 pandemic, and is still being seen to some degree now, although we have seen a bump in the CPI starting in June of 2020.

As White also noted in his article, much of the inflation debate last summer was silenced by recorded deflation from the months of March – May. This deflation can be attributed to the aforementioned business closures and job losses that spurred consumer uncertainty and resulted in the “hoarding” of cash. This isn’t a case of price rigidities, it is one where we have seen falling prices due to unprecedented shocks that have extended much longer than initial predictions.

Estimating the exact degree to which reduced mobility has been voluntary, i.e. having preceded the issuing of stay-at-home orders by state governments, is relatively hard, but it is clear that households have been absorbing the Fed’s creation of money balances due to future uncertainty about the economy and the pandemic’s direct effect on drops in spending outside of the household.

While many places across the nation and globe have begun the process of re-opening, or fully re-opened, the complete end of things like self-isolation has not been met, as vaccine distribution is still only partially underway.

If Biden’s forecasts for complete vaccination by America’s Independence Day this year become a reality, we are certain to see an uptick in spending as people begin to “return to normal.” It is crucial to note that predicting just how much people will spend or return to normal is immeasurable.

The concerns with double-digit inflation, as White notes, will require the Fed to reverse expansionary policy and easy-money tactics as the money supply with hang in a careful balance. The Fed cannot forecast the future, and there is no historical measure to rely on in modeling what is to come. As such, the Fed will need to be extraordinarily quick in responding to changes in consumer behavior that could drive things like demand-pull inflation as individuals and households begin consuming goods as normal.

“High inflation is not likely, provided that the Fed reverses its money injections as COVID-19 recovery and dis-hoarding begin. What is more worrisome is the Fed straying outside of its lane into fiscal policy, and the temptation to inflate away growing debt.”

Lawrence H. White

In August of 2020, Federal Reserve Chairman Jerome Powell announced that the Federal Reserve would no longer be following its strict 2% inflation target, and instead move toward a policy of average inflation targeting. This policy will allow inflation to run “hotter” than the Fed’s previous target of 2% after sustained periods of inflation below the target, and is aimed at supporting the labor market and other parts of the broader economy that are under economic distress.

As I mentioned in last week’s Substack, the way to finance deficit spending primarily comes from the issuance and sale of bonds. We’ve seen this already, with the Fed purchasing $2.5b in bonds per month in order to keep rates low. The Quantitative Easing we saw last year that bolstered the money supply is a short-term effect, and once the pandemic subsides we should not expect to see dramatic increases in the money supply caused by crisis spending. It’s important to remember that while the effects of the pandemic will have real effects, we shouldn’t see repetition of this and dangerous inflation so long as the Fed stays in its lane and doesn’t inflate away debt.

All in all, a lack of perfect foresight on part of the Fed means that it is hard to project future movements. What’s certain is that quick movement will be needed once consumers are back to spending thanks to a vaccinated population, and employment reaches pre-pandemic levels.

Thinking Rationally

As I mentioned in Monday’s Substack, I don’t see us reaching sky-high inflation like some fear, but I do expect it to rise above the projected 2.4% in the short-term.

It’s important to remember that while we may experience short-term increases in inflation or some level of over-production, they are not likely to last into the long-run, and detrimental impacts to a nation’s currency would have to come from longer periods of inflation, or a slow moving Fed that does not allow for policy to adjust accordingly.

It’s also important to remember that the Fed’s dual mandate is price stability and max sustainable employment. Right now, because of the mass layoffs caused by the COVID-19 pandemic, much of the focus has been on guiding the economy back to previous employment levels and thus increasing productive abilities relative to where we are now. This is why we have seen focus on keeping interest rates low and credit available to encourage spending and investment.

A main area of my own concern comes from all of the stimulus that's been pumped into the economy since last March, and the fact that it’s very hard to estimate exactly how many people are using this stimulus for rent, expenses, etc., and how many are saving, investing etc., and waiting for the economy to fully re-open before diving back into spending.

Low interest rates are of a secondary concern to me, because the economic growth projections from everyone (including the Fed now) already look promising. I’m worried that we enter a rapid boom and bust cycle, and I think that spurring all of this investment in production by making interest rates low and thus loans cheap could lead to the possibility of temporary and slight overheating, where suddenly things adjust back to normal we realize we over produced and see cuts in employment as businesses find production unsustainable.

The conventional economist might argue that we haven’t experienced anything yet, but that’s just it — we also have no foolproof measure of just how many people are holding cash and planning on spending later this year as things settle down and vaccines are distributed, as we resume normal life.

Mis-guided attempts to fear-monger hyper-inflation are prevalent in the crypto community, and while I agree that we will see a bump in temporary inflation, it’s a cardinal sin to ignore the entire macro-economic picture of both the United States and the world. Overall, the CPI isn’t failing to catch up with inflation expectations due to flaws in its construction, but because consumer spending has been suppressed as a part of the unprecedented shocks of the COVID-19 pandemic. While the Fed may be slightly undershooting inflation expectations, they are not doing so by a double-digit margin, and it’s important to acknowledge that we are not the only nation that has distributed stimulus packages or increased the money supply. Cryptocurrencies, primarily Bitcoin, pose value in their own right, without a need to exaggerate the state of inflation in the United States.

My DMs were once again flooded with those fearful of the market, but my advice has remained the same, remember: while high treasury yields are correlated with tech stock index falls, it's not like we haven't seen this before, a.k.a. last March. These things will rebound. Buy the dips (if you want, for legal purposes this is not financial advice) and ride it out.

thanks for breaking down things..